In the current fast-paced and aggressive organization environment, organizations are regularly searching for ways to streamline their financial operations, increase cash movement, and decrease administrative overhead. One alternative increasing recognition is factoring, an economic company that enables corporations to change their receivables into immediate cash factoring software. To manage and automate the factoring process effortlessly, several corporations are embracing factoring software. This short article considers factoring software, its advantages, characteristics, and how it may enhance organization operations.

What is Factoring?

Factoring is an economic arrangement in which a organization sells its accounts receivable (invoices) to an alternative party, referred to as one factor, at a discount. In exchange, the business enterprise receives immediate cash, which it may use for detailed wants like paying personnel, purchasing catalog, or growing operations. When the customer pays the account, the factor takes the payment, minus their fee.

Factoring helps corporations with poor or inconsistent cash movement prevent waiting 30 to 90 times for client payments. Alternatively, they can access immediate functioning capital, which helps maintain clean operations and growth.

What is Factoring Software?

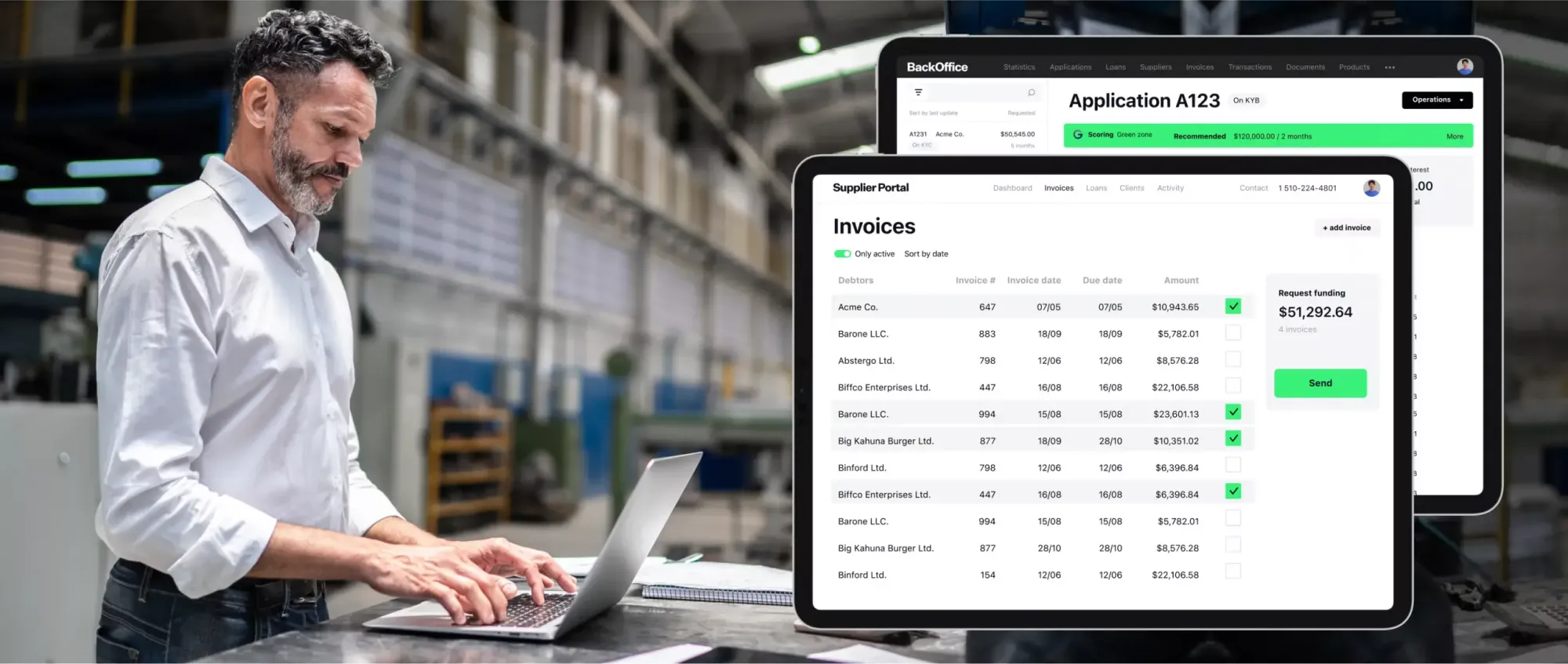

Factoring software is really a particular instrument designed to automate and enhance the whole factoring process. It streamlines responsibilities such as account administration, payment checking, risk assessment, and customer communication. Factoring software usually includes a variety of characteristics that support factoring organizations and corporations control the obtain and assortment of receivables effectively.

The key goal of factoring software is to remove handbook techniques, reduce the chance of human mistake, and offer real-time visibility to the position of transactions. By automating factoring, corporations may focus on growth rather than getting bogged down by time-consuming administrative tasks.

Features of Factoring Software

- Account Administration: Factoring software simplifies the process of submitting and checking invoices. It offers an prepared process where corporations can simply add, store, and access invoices. The software also allows consumers to monitor the position of every invoice—whether it has been compensated, is impending, or is overdue—ensuring greater visibility of cash flow.

- Real-Time Revealing and Analytics: With factoring software, consumers may produce detail by detail studies and analytics to monitor the efficiency of their factoring operations. The software songs crucial metrics like remarkable balances, ageing studies, customer payment traits, and factoring costs, permitting corporations to create informed decisions.

- Automatic Notifications and Pointers: Factoring software may send intelligent reminders to customers regarding due payments. That decreases the handbook effort needed to check out through to remarkable invoices and improves cash movement management. Additionally, it increases client relationships by giving regular and consistent communication.

- Chance Examination and Credit Scoring: Several factoring software solutions include integral credit scoring characteristics that assess the creditworthiness of customers. That function allows factoring organizations to analyze risk before purchasing receivables, ensuring they use customers who've a higher likelihood of paying their costs on time.

- Account Funding and Disbursement: Factoring software helps automate the process of funding invoices. When an account is permitted, the machine may calculate the funding total and disburse cash to the business enterprise quickly. Some software solutions even offer the choice of quick or same-day funding, which can be especially important for corporations that need immediate liquidity.

- Record Administration: The software provides for the storage and administration of most applicable certification related to factoring transactions. This includes agreements, invoices, customer correspondence, and payment records. With report administration characteristics, corporations may access all required papers from a main program and reduce paperwork clutter.

- Client and Client Website: Several factoring software solutions give a site for the factoring business and their clients. That site allows customers to view the position of their invoices, make payments, and speak with the factoring company. That self-service selection decreases the need for frequent calls or emails, keeping time for equally parties.

- Protection and Compliance: Factoring software guarantees knowledge security by employing encryption, protected consumer access controls, and typical backups. Additionally, it helps corporations conform to regulations related to knowledge security and financial revealing, like the Standard Data Safety Regulation (GDPR) and anti-money laundering (AML) requirements.

Benefits of Factoring Software

- Increased Cash Flow: Factoring software allows corporations to have faster use of functioning capital by simplifying and automating the factoring process. With faster handling times and effective checking of receivables, corporations may enhance their cash movement, which can be important for maintaining everyday operations.

- Time and Cost Savings: By automating responsibilities like account checking, payment reminders, and revealing, factoring software decreases the need for handbook intervention. That contributes to time and price savings, letting personnel to target on more strategic responsibilities rather than administrative chores.

- Better Chance Administration: With integral credit risk assessments and credit scoring, factoring software helps corporations decrease the chance of working with unreliable customers. This assists prevent costly foreclosures and poor debts that could usually affect cash flow.

- Enhanced Client Associations: Factoring software may increase interaction between corporations and their customers by giving consistent, automatic updates on account status. Customers benefit from regular reminders and easy payment possibilities, which can enhance their knowledge and reinforce the business enterprise relationship.

- Streamlined Operations: The centralization of factoring operations into one program makes it easier for corporations to manage numerous customers, invoices, and transactions at once. The software streamlines the whole factoring process, from funding to payment checking, ensuring smoother operations.

- Better Decision-Making: The real-time knowledge and analytics offered by factoring software offer corporations with important insights into their factoring performance. These insights may be used to create greater financial conclusions, recognize traits, and enhance organization operations.

How Factoring Software Helps Different Types of Businesses

- Small Firms: Small corporations with limited cash movement may greatly benefit from factoring software since it allows them to gain access to functioning capital quickly. By outsourcing the administrative burden to factoring software, they can focus on growth without fretting about overdue invoices.

- Factoring Businesses: Factoring software is especially ideal for factoring firms that control big quantities of invoices. The software helps them assess customer creditworthiness, control numerous customers, and automate the whole factoring process, making operations more effective and scalable.

- Freight and Logistics Businesses: Freight factoring is popular in the transportation market, where trucking organizations usually count on factoring to enhance cash flow. Factoring software designed to the freight market may control trucker invoices, facilitate fast payments, and offer detail by detail revealing for greater decision-making.

- Service Providers: Service-based corporations that matter invoices because of their solutions, such as advertising agencies, contractors, or IT firms, also can benefit from factoring software. It allows them to quickly factor invoices, freeing up capital to finance constant tasks and grow operations.

Conclusion

Factoring software is an important instrument for corporations looking to streamline their factoring techniques and enhance their cash flow. By automating responsibilities like account administration, payment checking, and customer communications, factoring software saves time, decreases human mistake, and improves overall efficiency. The benefits are not just limited by little corporations but also expand to factoring organizations, company companies, and logistics businesses.

The capability to control receivables, assess credit risk, and get real-time insights into financial efficiency makes factoring software an essential asset for organizations seeking to improve their financial operations. Whether a company is seeking to enhance its liquidity or streamline operations, factoring software gives the various tools needed seriously to succeed in a aggressive marketplace.